All Categories

Featured

Table of Contents

This policy layout is for the consumer who requires life insurance policy but would love to have the ability to select exactly how their cash worth is spent. Variable plans are underwritten by National Life and distributed by Equity Services, Inc., Registered Broker/Dealer Affiliate of National Life Insurance Policy Business, One National Life Drive, Montpelier, Vermont 05604.

A entire life insurance policy plan covers you permanently. It has money worth that grows at a fixed rates of interest and is one of the most usual type of irreversible life insurance policy. Indexed universal life insurance is also irreversible, but it's a details sort of universal life insurance policy with cash money value connected to a securities market index's efficiency instead of non-equity earned prices. Then, the insurance company will pay the face quantity directly to you and terminate your policy. Contrastingly, with IUL plans, your survivor benefit can boost as your cash worth expands, bring about a potentially greater payout for your beneficiaries.

:max_bytes(150000):strip_icc()/pros-cons-indexed-universal-life-insurance.asp_v1-e119226901bc464593a496c003551ea0.png)

Discover the several advantages of indexed universal insurance coverage and if this sort of policy is ideal for you in this insightful short article from Protective. Today, many individuals are looking at the value of permanent life insurance policy with its capacity to give long-term security along with cash worth. indexed universal life (IUL) has come to be a preferred selection in providing permanent life insurance security, and an also higher possibility for growth through indexing of interest credits.

What is a simple explanation of Iul Plans?

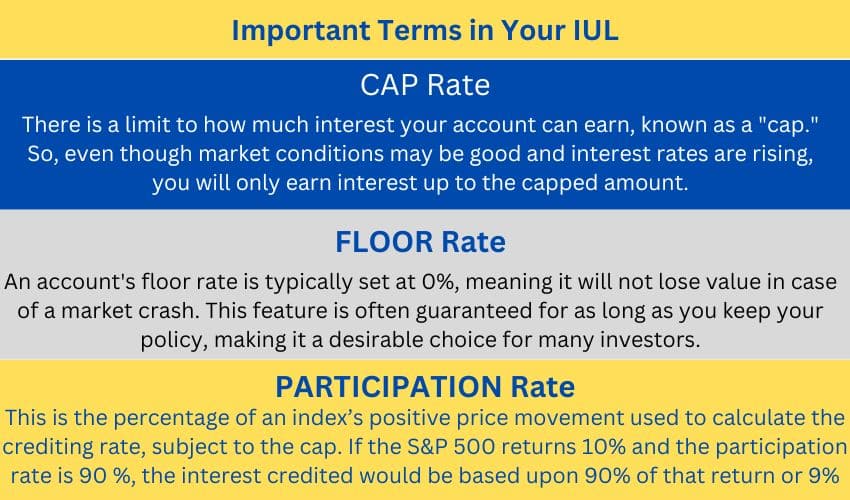

However, what makes IUL various is the way rate of interest is attributed to your policy. In addition to providing a standard stated interest rate, IUL provides the chance to earn interest, subject to caps and floorings, that is linked to the performance of a selected option of market indices such as the S&P 500, Dow Jones Industrial Standard or the Nasdaq-100.

With IUL, the insurance policy holder decides on the amount assigned among the indexed account and the fixed account. This implies you can pick to contribute even more to your policy (within government tax legislation restrictions) in order to help you develop up your cash worth even much faster.

As insurance policy plans with investment-like functions, IUL plans charge compensations and charges. These costs can minimize the cash worth of the account. While IUL plans additionally offer guaranteed minimum returns (which may be 0%), they additionally cover returns, even if your pick index overperforms (Indexed Universal Life vs whole life). This indicates that there is a limitation to rate of cash money value growth.

Written by Clifford PendellThe pros and cons of indexed universal life insurance policy (IUL) can be challenging to make feeling of, specifically if you are not aware of how life insurance policy works. While IUL is among the hottest items on the marketplace, it's likewise among the most unpredictable. This kind of insurance coverage may be a viable choice for some, but also for a lot of people, there are better options avaiable.

What is the difference between Indexed Universal Life For Wealth Building and other options?

If you have an unfavorable return, you will certainly not have an unfavorable attributing rate. Instead, the rate will normally be 0 or 1 percent. Additionally, Investopedia checklists tax benefits in their benefits of IUL, as the survivor benefit (cash paid to your beneficiaries after you pass away) is tax-free. This holds true, yet we will add that it is additionally the situation in any type of life insurance policy, not just IUL.

These add-ons can be bought for other sorts of policies, such as term life insurance coverage and non-guaranteed global life insurance coverage. The something you need to understand about indexed global life insurance coverage is that there is a market danger entailed. Spending with life insurance policy is a different game than purchasing life insurance coverage to protect your family, and one that's not for the faint of heart.

For example, all UL products and any kind of general account product that depends on the efficiency of insurance companies' bond portfolios will certainly undergo rates of interest risk."They continue:"There are fundamental threats with leading customers to think they'll have high rates of return on this product. A customer may slack off on funding the cash money worth, and if the policy does not carry out as anticipated, this can lead to a gap in insurance coverage.

And in 2020, Forbes released and write-up entitled, "Appearing the Alarm on Indexed Universal Life Insurance Coverage."Regardless of hundreds of articles cautioning customers concerning these plans, IULs continue to be one of the top-selling froms of life insurance policy in the United States.

How do I apply for Indexed Universal Life Account Value?

Can you deal with seeing the supply index choke up understanding that it straight influences your life insurance policy and your capability to safeguard your family members? This is the final digestive tract check that deters also exceptionally affluent capitalists from IUL. The entire point of purchasing life insurance is to reduce threat, not develop it.

Find out more about term life here. If you are seeking a policy to last your whole life, take a look at ensured global life insurance policy (GUL). A GUL plan is not practically irreversible life insurance policy, however rather a hybrid in between term life and universal life that can enable you to leave a legacy behind, tax-free.

Your cost of insurance coverage will not alter, also as you get older or if your health and wellness changes. You pay for the life insurance coverage security only, just like term life insurance.

What is Iul Vs Whole Life?

Surefire universal life insurance policy is a fraction of the price of non-guaranteed global life. JRC Insurance Coverage Group is right here to assist you find the best policy for your requirements, with no added expense or fee for our assistance.

We can retrieve quotes from over 63 top-rated service providers, permitting you to look past the big-box business that often overcharge. Consider us a pal in the insurance coverage sector who will certainly look out for your ideal interests.

Who offers flexible Iul Financial Security plans?

He has actually assisted thousands of families of organizations with their life insurance policy requires considering that 2012 and specializes with candidates that are less than excellent wellness. In his extra time he appreciates spending time with household, traveling, and the open airs.

Indexed universal life insurance can assist cover several economic requirements. It is simply one of lots of kinds of life insurance policy offered.

Latest Posts

Universal Vs Term Insurance

Iul Investment Calculator

Universal Life Policy Vs Term